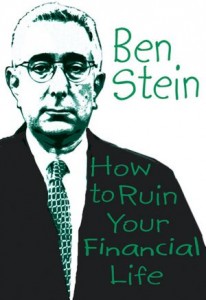

In his book How to Ruin Your Financial Life, economist, finance expert, and actor Ben Stein lists 55 tongue-in-cheek ways to ruin your finances and end up in bankruptcy. Would anyone like to know what they are? Anyone….Anyone….?

I still remember my shock and amazement years ago when I discovered that the Ben Stein who played Ferris Bueller’s teacher in the movie Ferris Bueller’s Day Off back in the 80’s was the same Ben Stein who shares financial advice in books and on TV.

Stein has had an interesting career as a presidential speechwriter, lawyer, economist, actor, and more!

Stein has had an interesting career as a presidential speechwriter, lawyer, economist, actor, and more!

I’ve enjoyed his humorous, tongue-in-cheek take on life in other books like How to Ruin Your Life and How to Ruin Your Love Life.

How to Ruin Your Financial Life did not disappoint.

It’s a small book, and about 130 pages, so it’s a quick read. In fact, I read it in about an hour. And it’s hilarious.

Personally, it would have been even more funny if I hadn’t seen myself and my past mistakes in it so much, as he describes what to do (and conversely, what not to do) if you want to ruin your financial life.

Yeah. I’ve made many of the mistakes that Stein shares in this book!

How to Ruin Your Financial Life is a great book for anyone who is just starting out in life, or who needs to make some serious changes in their finances.

20 Ways to Ruin Your Financial Life

The whole book is great. But here are 20 tips that were of special interest to me, listed here with their number in How to Ruin Your Financial Life along with my take on them.

#1. Forget about tomorrow. It’s so easy to get wrapped up in the day-to-day if we don’t have a plan for how we want to live in the future.

#2. Know with certainty there will never be any rainy days in your life. Wow, that’s a lesson we’re trying to teach our 16 year-old son, now that he’s working outside the home and wants to spend most of what he earns on “fun” stuff now. But now that work has been slow, and he hasn’t worked a week or two, he’s realizing the importance of saving for a “rainy day.”

#4. Save money only when you feel like it, and if you just don’t feel like saving, then don’t! Ha Ha, systematic savings is easier than ever now with online checking and savings accounts from ING and other financial institutions.

#6. Spend as much as you want, and don’t be afraid to go into debt. I definitely learned this the hard way, myself, when I was in college.

#7. Set up a high-profile, high-consumption lifestyle with enormous fixed expenses that you can’t afford. Nothing sucks the life out of your finances faster than realizing you’ve got no margin, no room to breathe, because all of your money has been pre-committed to fixed expenses like a mortgage, car loan, personal loan, etc.

#12. Collect as many credit cards as you can, and use them frequently. I think I had 5 or 6 cards at the most at one time, back 15 years ago: A couple of Mastercards or Visas, and couple of gas cards, and a couple of department store cards.

#13. As soon as you’ve succeeded in maxing out your credit cards…get new ones! I think I maxed out one card years ago, and it was because of repairs we had to make to our rental house, and we didn’t have money set aside in an emergency fund for those repairs.

#14. When you get your credit card bills, pay only the minimum each month. Been there, done that. I thank God that we haven’t carried a balance on credit cards in years.

#16. Repeat after me: “I am not responsible for my financial well-being.” Wow, this is a big lesson I want to instill in my kids, especially as I mentor my three teenage boys in entrepreneurship. If we don’t have a plan for our finances, someone else certainly does, and they are not looking out after our best interests!

#17. Trust that there’s always more money coming in. I’ve made this presumptuous mistake so many times. This is one big lesson that many have learned in the economic downturn over the last four years.

#19. Learn the Ultimate Rule of Success – Money spent on appearances is the best money you can spend. Yep, we’ve struggled with this one before. It’s sad that we judge people based on their appearance of success, and yet the appearance in now way is a true reflection of success.

#21. Don’t think about retirement – it’s a l-o-o-n-n-g way off. A few weeks ago, I shared with my boys the power of compounding interest especially with regard to retirement. They were amazed to think of how much money they would have if they started a savings plan now and stuck with it consistently throughout their lives.

#24. Make a point of watching those late night financial success infomercials. I don’t think I’ve ordered anything off of those late night infomercials…well, maybe I got a Ron LeGrand (he’s a real estate investing guru) CD that way once.

#27. Convince yourself that you can beat the market without knowing anything about it. Yeah, well, I did buy some stock in Palm Computing without doing any research or having any knowledge of what was happening with the company and industry. It was extremely low and I assumed it had no place to go but up. Boy was I wrong. It eventually did a reverse stock split. I invested less than $100 and lost it all.

#35. Put all your eggs in one basket – ’cause only sissies diversify. Gratefully, I’ve never thought this way.

#40. If taking charge of your financial life seems overwhelming now, just put it off for a few more years. I wonder how many people in America think this way?

#44. Believe that you can get rich quick – that you can get something for nothing. I’ve never believed you can get something for nothing, but I have been amazed at how some people seize opportunities that others don’t to take something very small and make it very big.

#45. Know without a doubt that you don’t have to work hard – you only need to find an angle. Hmm…

#47. Feel confident that you can borrow your way out of any problem. Why not, the government seems to think this will work. 😉

#50. Don’t sweat the small stuff – after all, $10 or $20 a day doesn’t really add up to much! I hate to think of how much money I’ve frittered away over the years on dumb stuff like soda pop and junk food.

So there you have it, my top 20 list of Ben Stein’s tips on How to Ruin Your Financial Life.

If you’re sure you want to ruin your financial life, just do what Stein says here. However, if you think you want to improve your financial life and grow your net worth, maybe you should do just the opposite.

Hey, I’d love it if you’d subscribe to my blog. And please leave a comment about which of these lessons have you learned the hard way. Thanks!!

Rich I hope you had a great Thanksgiving! I miss you in the blogosphere. Great post that I think all graduating high school seniors should read.

Hey Marvin, yes we did have a great Thanksgiving – hope you did too. Yeah, I’ve gotten a bit behind in my writing here, and in connecting on other blogs. Hope to get back in the groove this week. Thanks so much for checking in!